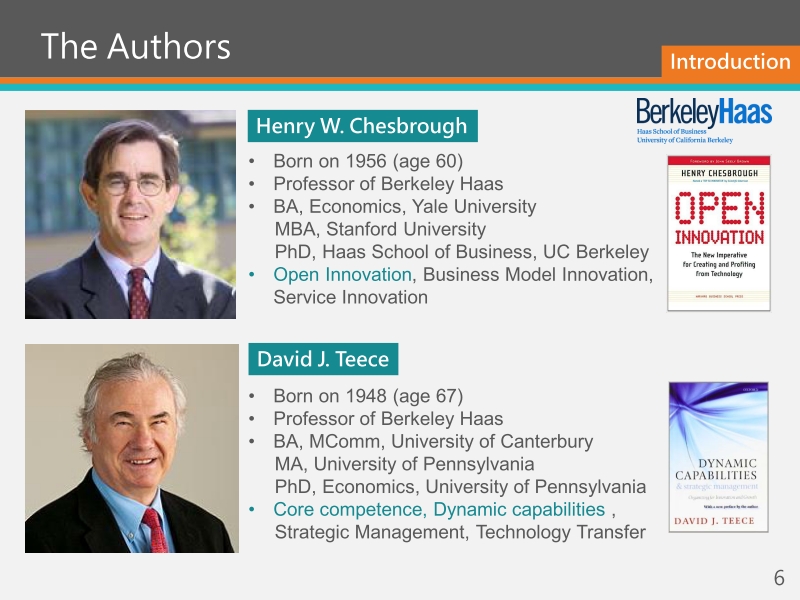

Teece, D. J., & Chesbrough, H. W. (2002). Organizing for Innovation: When Is Virtual Virtuous. Harvard Business Review, 80(1), 127-135.

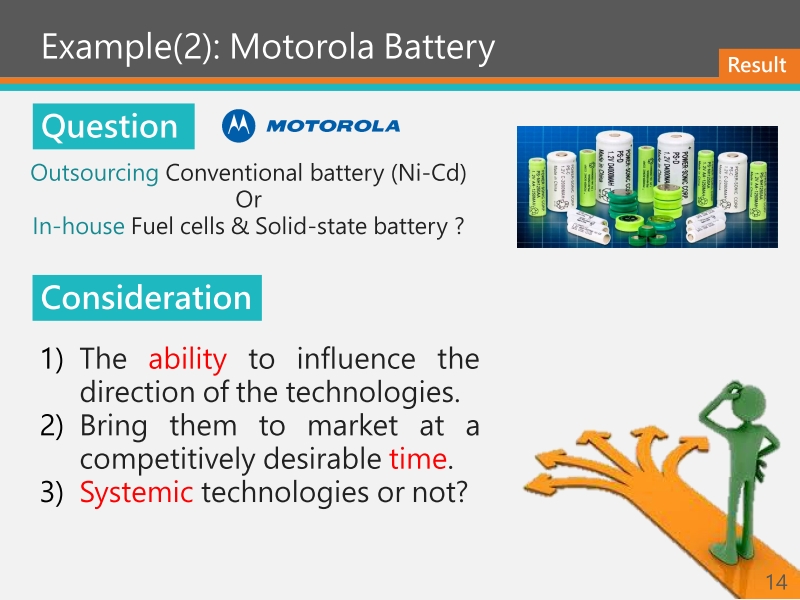

Advances in information technology have made it easier for companies to exchange data and coordinate activities. That has given rise to a radical new vision of corporate organization—one in which individual companies outsource many of their activities to an array of partners. Such virtual enterprises may be more efficient, but what are the broader strategic implications of rampant subcontracting?

Henry Chesbrough and David Teece sound a note of caution. When it comes to innovation, they argue, virtuality often does more harm than good. Loose partnerships of companies inevitably produce more conflicts of interest than do centrally managed corporations, and those conflicts can hamper the kind of complex, systematic innovation that creates valuable business breakthroughs. Innovation is a destabilizing force and will therefore be resisted by companies wary of upsetting a comfortable status quo.

Chesbrough and Teece acknowledge that some degree of outsourcing can further corporate creativity and that virtuality makes sense under certain conditions. But every company, they contend, needs to tailor its organization to its own operations and its unique sources of innovation. Blindly following fads is a recipe for disaster.